Market Betas & Alphas

Market Betas & Alphas

Occasionally, an acquaintance or friend will come ask me how to invest in the markets or if there is some heuristic to speed up the learning curve, especially with so many sources of misrepresentation out there. Being in markets starting from discretionary macro to more systematic and algorithmic recently, I have some thoughts to share. Perhaps this can be valuable to someone out there.

Most people should be realistic about the kind of returns they can expect for the risk they take. One should consider the volatility appetite, time horizon, research and execution sophistication. One is unlikely to run a high Sharpe, high touch, fee sensitive strategy with a simple set up.

When trading the long time frame, it is easy to make small returns. If you want to make big returns, you need to trade the smaller time frame as you are diversifying more trades over the more frequent time horizon but it is harder and more competitive to trade here.

Moving up the complexity/returns curve, below are some sweet spot strategies people can consider running.

Retail Friendly Strategies

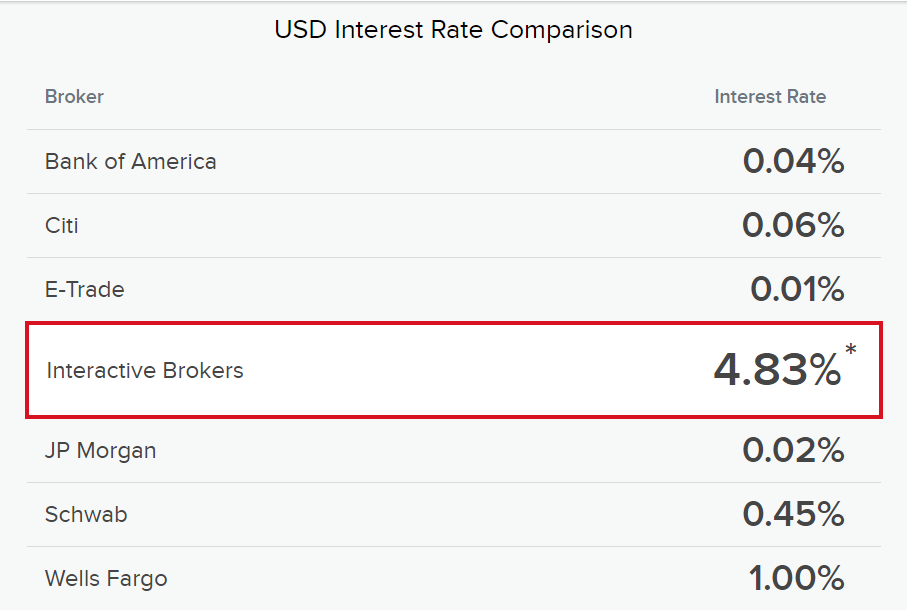

1. Earning returns on USD Cash Balance at IBKR

IBKR Returns

IBKR Returns

As of now, you can park USD in IBKR and get a decent 4.83% cash balance on your USD. The usual follow-up question people ask is how safe it is to put funds with IBKR. In their own words, there are some sort of sizable SIPC protection in the event of a broker-dealer failure. This is an easy hands-off high liquidity way to put money to work.

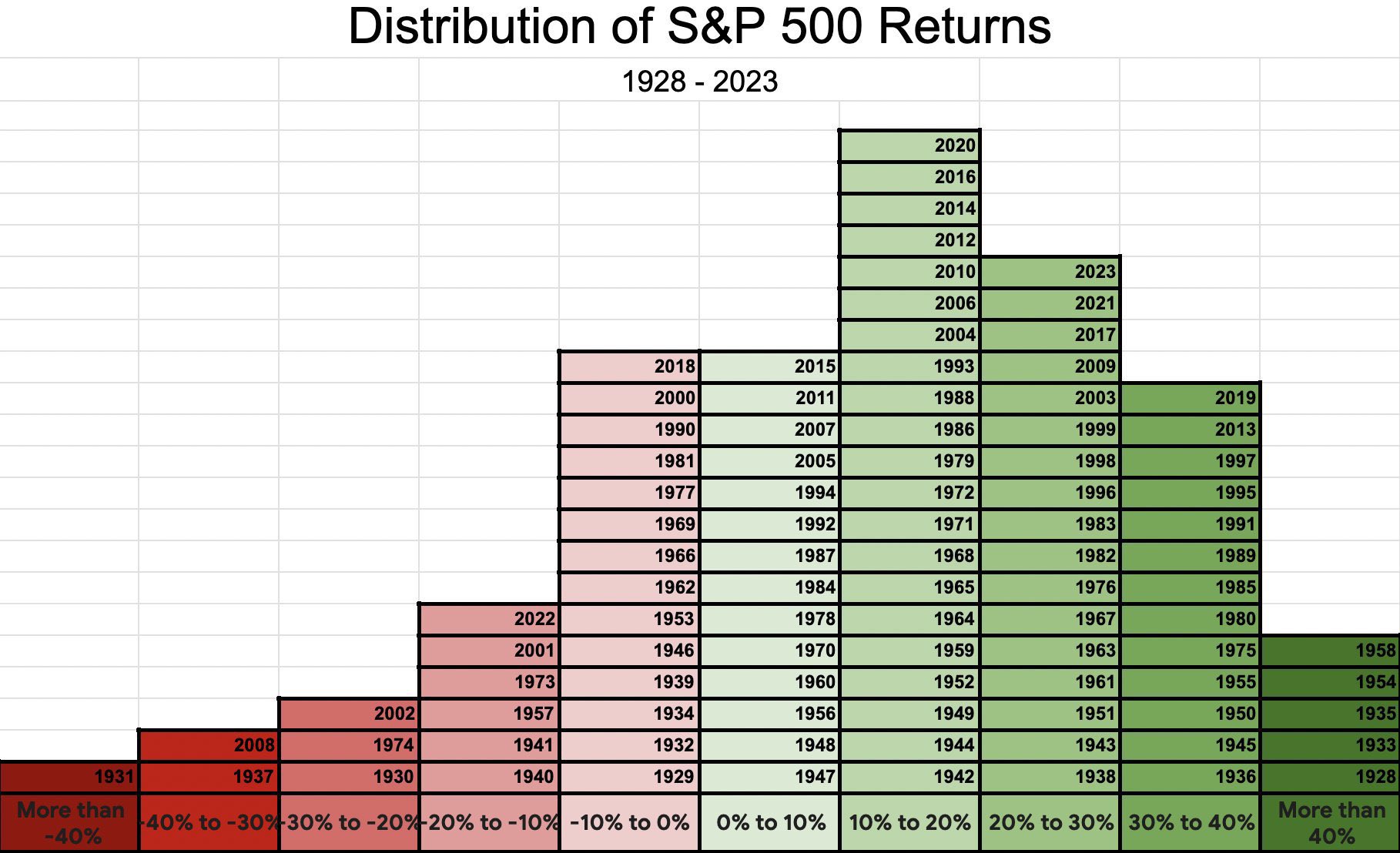

2. Dollar Cost Averaging in S&P

This is the standard wisdom for building any core long-term portfolio. S&P 500 contains the largest, typically most innovative and competitive companies. This also forms the bulk of most pension and endowment portfolios so there will be natural buying pressure. Policy makers have incentives to buffer downside volatility on this asset for populist reasons, also known as the Fed put.

S&P Return Histogram

S&P Return Histogram

The S&P typically has a positive skew on long-term returns due to the equity risk premium, averaging 5-8% a year. Investors are paid to take the higher risk of equities over bonds.

VOO Weekly Chart - imo public market investing is a solved problem

VOO Weekly Chart - imo public market investing is a solved problem

Some say public market investing is a solved problem and there is little value add from doing individual stock picking - just buy the index instead. Unless one has other incentives like career incentives to run a long beta portfolio with lower volatility and there are investors willing to pay the premium for that.

There are other variants of buying the VOO, like buying XLG - the top 50 companies, or QQQ - the Nasdaq variant. Generally they all move the same and have similar beta exposure.

As usual, be cognizant of your Value at Risk when a sudden market impact event arrives, especially when you are fully deployed.

If you are a SG investor and plan to hold the ETF forever, consider CSPX.L instead of VOO to better handle US dividend withholding tax and estate tax. Source: Reddit

3. Thoughts on Single Name Stock Picking

Most retail shouldn’t spend too much time here. It’s not worth the time and it is unlikely you will size a single name up to give sizable return vs a full portfolio allocation to the index. But arguably, many have this intellectual / gambling itch they want to scratch. If you really want to do so, just put a small size and see it as a lottery ticket. If you are a professional, you might be able to dig out some new info not fully disseminated and understood by the market yet and that could be your edge.

4. Thoughts on Options for Retail

Generally, retail should view this as a -EV lottery ticket. Option is a market marker’s game where they have better visibility of the fair value and they make the spread around that. Retail see this as an easy way to get leverage without awareness of how much they are overpaying for the option. In fact the +EV lies with selling volatility, to take the other side of asset managers who overpay for vol to hedge their portfolio for career concerns.

Professional Strategies

Statistical Arbitrage - Pairs, Mean Reversion, Momemtum

Trade the spread between 2 or a basket of instruments when the probabilistic expectation that it may converge (mean revert) or divert (momentum). You find and use an alpha feature that may give you some predictive information.

When you do mean reversion, you want to find a good reason why the pair is cointegrated and might revert and not data mine too much. EURGBP mean reverts well because the 2 economies are closely related. GLD and GDX should mean revert because the underlying factor is gold price.

In trend following, ideally you want to use a large portfolio of uncorrelated assets to diversify correlation risk of assets. You buy what moves up and sell what does down. Watch out for leverage to control portfolio drawdown. Similarly, don’t overfit too much and watch out for trading costs.

Stats arb is typically used in hedge fund pods as its delta neutral, with tight drawdowns and investors pay for uncorrelated alpha returns.

Cryptocurrency Specific Strategies

1. Arbitrage

Trade two fungible instruments by buying low on one exchange and selling high on another, then recycle the funds. Historically, traders bought Bitcoin on liquid, developed US/European exchanges and sold it in emerging markets like Korea for a premium. Highly competitive these days as once sighted, someone will try to arb it away.

2. Cash & Carry

You can long or short a dated delivery contract and hedge against a swap contract. Or you can long spot and short futures. This strategy can be executed manually and is particularly attractive when the future basis is heavily skewed, such as in a strong bull market.

3. Funding Arbitrage

To implement this strategy, you need real-time and historical funding data of perpetual contracts across multiple exchanges. The funding difference between venues must be significant and expected to persist long enough to cover trading fees. Note the capacity constraint, as you want to enter and exit positions with minimal slippage. Some traders automate entries and exits to capitalize on favorable price levels.

4. Market Making

In the realm of HFT traders. This strategy is sensitive to fees, due to high volume and small scalps, so the volatility/fee ratio must be justified. Latency is also crucial, as you need to react quickly to price changes. Identifying the fair value is essential - many traders use Binance’s mid-price due to its high volume. Specifically, fair value is often the volume-weighted average of the mid-price across all exchanges. This global mid-price provides arbitrage bounds when quoting on local exchanges.

To gain execution priority, quote near the top of the order book on the local exchange, but stay within the bounds of the global fair value. This approach is sometimes called the “stink bidder” strategy, where you fade the wicks and liquidation spikes on a thin order book exchange and profit when the price reverts to fair value as other arbitrageurs step in.

To minimize latency, position yourself near the same cloud region as the exchange. For example, Binance servers are in AWS Tokyo, and most crypto exchanges have servers in the Asia region. For an additional trading edge, you can pay the exchange for co-location services.

This is a potential source for capacity constrained high returns. Typically you want to mirror liquidity from a liquid exchange to a slower less liquid exchange. Perp dex are interesting are they use on-chain price oracles which can lag the true price. In the event if there is some point farming program on the perp dex, there can be price insensitive wash trading which is great for a market maker quoting around the fair price.

From an engineering perspective, building a robust market-making trading engine can be challenging. You need to handle errors, edge cases, rate limits, and connectivity delays effectively. You need to read the docs to figure out how to implement the connectors correctly. Some use Python with Numba here for fast development and ideation, many use Rust for the fast compute and tick-to-trade.

4. Airdrops

Airdrops feel like participating in a Ponzi scheme where you are promised some Ponzi rewards and ideally you want to cash out before the scheme collapses. Projects use point farming programs to create an illusion of high user activity to raise at a higher valuation. Maybe ok to participate in a strong bull market but remember that if you are staking some assets, you are selling liquidity puts which can turn toxic fast like locked Luna during the UST bubble collapse.

5. Shitcoin Pump & Dump

This is an adversarial zero sum game where KOLs will promote a specific low cap coin and retail will bid it up excitedly, and be more excited as the coin pumps. At the sight of the first key red candle, the upwards momentum will collapse and participants all race to the exit and some will be left bagholding the coins. Most people will not have an edge unless you are part of the KOL syndicate or you track them closely.

Conclusion

End of the day, you want to choose where you want to compete in, with regards to your strengths, constraints and opportunity set.